Tax expert, Mark Chapman, director of Tax Communications at H&R Block Australia, shares his top tips for maximising your refund this year.

With 84 per cent of taxpayers expecting a refund this end of financial year, and the average size of refunds last year reaching nearly $3,600, it pays to spend time ensuring you’ve got every detail of your return right, including your stationery!

Working from home – What You Can Claim

If you work from home, you can claim a tax deduction for the work-related proportions of household costs such as:

1. Heating, cooling and lighting bills

2. Costs of cleaning your home working area (including cleaning products or payment for a domestic cleaner if required)

3. Depreciation of home office furniture and fittings

4. Depreciation of office equipment and computers

5. Costs of repairing home office equipment, furniture and furnishings

6. Small capital items such as furniture and computer equipment costing less than $300 can be written off in full immediately (they don’t need to be depreciated)

7. Computer consumables (like printer ink) and stationery

8. Phone (mobile and/or landline) and internet expenses

Ideally, you should have a specific room set aside as a home office. If you are using a room with a dual purpose (e.g. dining room), or a room shared with others (e.g. lounge room), you can only claim the expenses for the hours you had exclusive use of the area.

Three Ways to Calculate Home Office Costs

Three Ways to Calculate Home Office Costs

1. 80 cents per hour - The ATO’s 80 cents per hour method covers everything including items like mobile phone and internet usage. This temporary “shortcut method” is available until 30 June 2022 (but not beyond that date). You will need to keep a record of the number of hours you have worked from home as a result of COVID-19.

2. Flat rate allowance of 52 cents per hour - You can claim 52 cents per hour for each working hour plus separate claims for the work-related proportion of items such as home Internet, mobile phone costs and other expenses that directly relate to your work such as stationery and printer ink. All you need to do to claim this is to keep a diary – note the time you start work each day, the time you finish work each day and any breaks. These additional costs often make this a preferred method since the size of the claim is often much larger than using the 80 cent rate.

3. Actual Costs - You can claim the actual costs you’ve incurred by keeping a diary of your work from home hours (for a typical 12-week period) and you’ll also need to work out the amount of your home (by floor area) that you’re using as your workspace. From this, you can then work out the work-related proportion of your household expenses and apply this percentage to the actual amount you spend on electricity, gas, water, phone and internet, etc. You’ll also need to keep all the original bills to prove your claim.

This generally produces a bigger claim than either of the flat-rate methods but the amount of paperwork and calculation involved is much greater.

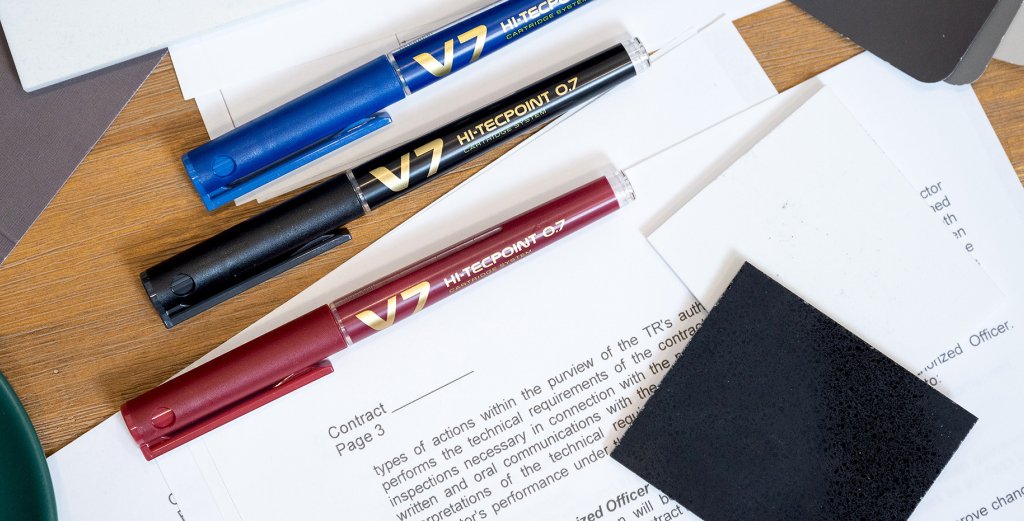

Claims for Stationery

Claims for Stationery

Provided it is for work-related use, you can claim a tax deduction for all stationery purchases in the period in which you make the purchase and provided it’s used exclusively for work-related purposes, there is no limit to what you can claim. If certain items are used partly for work use and partly for private use, you can claim the work-related proportion of the cost.

“Pre-ordering” (ie, ordering before EOFY for the next tax year) is a very sensible strategy for saving on tax. You can order all your favourite pens in bulk for the year ahead or even purchase a high-end fountain pen such as PILOT’s Falcon or Custom 823 (popular with doctors and lawyers!) as long as it’s used for work-related purposes. (If the item is over $300 you are required to claim over a number of years - the exact number depends on the effective life of the asset).

Claims for Self-Education

You can claim the cost of any work-related courses that you undertake, provided that they relate directly to your current role and aren’t intended to boost your skills into a promotion or another role entirely. In addition to the cost of the course, you can claim travel costs to and from the course, accommodation and meals if you’re required to sleep away from home, books, stationery and depreciation on computer equipment used in your study.

To find out more about your Working From Home or small business tax benefits, visit H&R Block Tax Accountants.

To pick the perfect pen to set you up for the new financial year ahead, visit our PILOT Pen Finder.

About Author

H & R Block AU

As Australia’s largest preparer of personal income tax returns, H&R Block also offers a range of services to small business clients, including bookkeeping and accounting services. Our highly trained professionals will help you understand how the tax laws apply to your situation and help maximise your tax position.